Bitcoin (BTC) is poised at a pivotal moment, with the potential for a significant short squeeze or the onset of a new bear market. As the week begins, the cryptocurrency is trading above a key 200-week trend line, a development that has sparked optimism among bulls for a rally to $75,000. However, the market remains volatile, and the path forward is fraught with uncertainty.

A Technical Crossroads

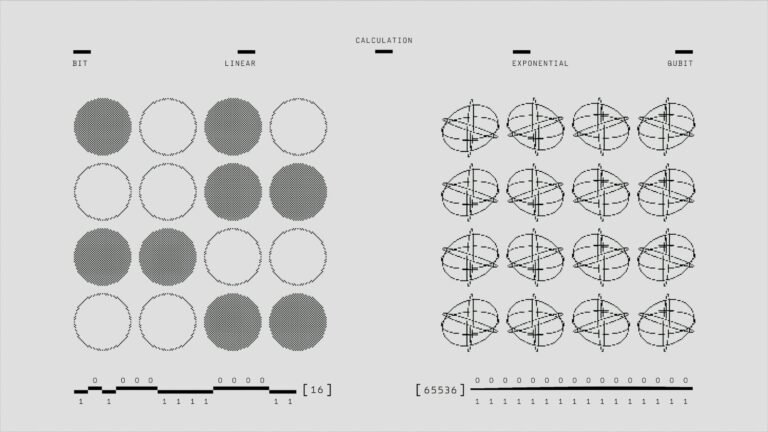

At approximately $68,800, Bitcoin closed the week above a crucial long-term trend line, the 200-week exponential moving average (EMA). This level, currently at $68,343, and the old all-time high of $69,000 from 2021, are critical support and resistance points. Analysts are closely watching these levels as they could determine the direction of the next major move.

“We’re back inside an old important range that kept price for 7 months!” trader CrypNuevo noted on X, referring to the extended rangebound construction around the $69,000 mark that BTC/USD formed in 2024.

Liquidations and Market Sentiment

Despite the relatively stable price action since the recovery from the $59,000 lows, the market remains highly sensitive to even minor price movements. Liquidations have been elevated, with CoinGlass reporting over $250 million in liquidations over the past 24 hours. Both long and short positions are being repeatedly erased, especially around the $70,000 level.

Trader CW observed that long positions remain dominant, despite significant liquidations. “Despite significant liquidation of $BTC long positions, longs remain dominant. Expectations for a bullish trend remain intact,” CW told X followers. However, the market’s resilience will be tested if spot demand does not follow the recent short squeeze.

Macro Economic Indicators and Volatility

The week ahead is packed with key economic data, including the Personal Consumption Expenditures (PCE) Index and Q4 GDP data, both due on Friday. These releases could significantly impact market sentiment and volatility. The PCE Index, the Federal Reserve’s preferred inflation gauge, is particularly important given the mixed economic signals from recent inflation numbers.

“Expect more volatility this week,” The Kobeissi Letter warned, summarizing the upcoming macro events. The Fed’s policy decisions remain a wildcard, with CME Group’s FedWatch Tool indicating over a 90% probability that interest rates will remain unchanged at the next meeting.

Onchain Analysis and Investor Resilience

CryptoQuant’s latest research highlights the importance of investor resilience in the current market. The platform’s contributor, GugaOnChain, warned that a showdown could occur at the confluence of two key price points below $60,000: Bitcoin’s 200-week simple moving average (SMA) and its overall realized price at $55,800.

“Bitcoin’s 50% collapse toward the 200-period moving average on the weekly timeframe — which converge with the region of its realized price at $55,800 — will be a significant test, besides being seen by analysts as a region conducive to accumulation,” GugaOnChain wrote.

The net unrealized profit/loss (NUPL) indicator, which measures the profitability of overall BTC holdings, is currently in the “fear region” at 0.201. This low value suggests that many holders are underwater, and the market may be setting up for a broader bear phase.

A Regime Shift?

CryptoQuant’s adjusted spent output profit ratio (aSOPR) further supports the bearish outlook. The metric, which measures the proportion of coins moving onchain at higher levels compared to their previous transaction, dropped below 1 on February 6, indicating realized losses on a scale not seen since 2023.

“In 2019 and 2023, similar readings occurred during deep corrective phases where coins were being spent at a loss. Each time, this zone represented capitulation pressure and structural reset. Now, aSOPR is again pressing into that same region,” contributor Woo Minkyu commented.

If aSOPR fails to reclaim 1 soon, it could signal a broader bear phase rather than a simple correction. The market’s structure currently resembles prior bear transition phases, with sustained weakness and loss realization.

Conclusion: A Path Forward

Bitcoin stands at a critical juncture, with the potential for a significant rally or a bear market regime shift. The key levels around the 200-week EMA and the old all-time high will be crucial in determining the next move. While bulls remain hopeful for a surge to $75,000, the elevated liquidations and onchain profitability data suggest that the path forward is uncertain. Traders and investors should remain vigilant and prepared for either outcome, as the market continues to navigate through a period of heightened volatility and macroeconomic uncertainty.