In a significant setback for its ambitious Bitcoin acquisition strategy, Metaplanet has reported a staggering ¥102.2 billion (approximately $660 million) loss. This figure, reflecting a year-end mark-to-market accounting adjustment under Japanese rules, highlights the volatility and risks inherent in holding a large Bitcoin reserve. Despite this substantial hit, the company remains committed to its goal of acquiring 210,000 Bitcoin by 2027, aiming to own 1% of the total Bitcoin supply.

The Scale of the Challenge

Metaplanet’s journey to 210,000 Bitcoin is fraught with challenges. To achieve this target, the company must acquire roughly 100,000 Bitcoin over the next four years. This is no small feat, especially given the current market conditions and the company’s recent financial losses. The Bitcoin market is notoriously volatile, and the price fluctuations can significantly impact the cost of acquiring additional Bitcoin.

Market Analysis and Strategic Implications

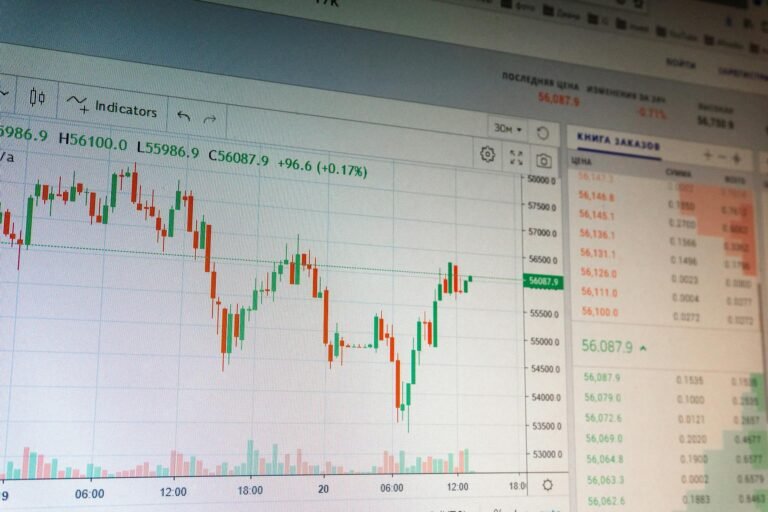

The Bitcoin market has seen a mix of bullish and bearish trends over the past year, making it challenging for investors to predict future movements. According to Mike McGlone, a senior analyst at Bloomberg, the recent price action suggests that Bitcoin is consolidating in a range between $20,000 and $30,000. This consolidation phase could provide Metaplanet with opportunities to acquire Bitcoin at more favorable prices, but it also increases the risk of further mark-to-market losses.

Metaplanet’s strategy is not just about acquiring Bitcoin; it’s also about building a robust ecosystem around the cryptocurrency. The company has been actively investing in blockchain technology, decentralized finance (DeFi) projects, and other crypto-related initiatives. These investments are designed to create a sustainable and diversified revenue stream, which can help mitigate the risks associated with holding a large Bitcoin reserve.

Expert Insights and Forward-Looking Strategies

Industry experts have mixed opinions on Metaplanet’s strategy. Kevin O’Leary, a well-known investor and Shark Tank personality, believes that Metaplanet’s long-term vision is sound but acknowledges the short-term risks. "Acquiring 210,000 Bitcoin is a bold and ambitious goal, but it requires a well-thought-out strategy and the ability to weather market volatility," O’Leary stated. "Metaplanet needs to focus on building a strong, diversified portfolio and ensuring liquidity to manage potential downturns."

Vitalik Buterin, the co-founder of Ethereum, offered a more nuanced perspective. "While Bitcoin remains a crucial component of the crypto ecosystem, it’s important to consider the broader landscape of digital assets and decentralized technologies. Metaplanet’s approach should be adaptive and flexible, allowing it to pivot if necessary."

Conclusion: A Long-Term Vision Amidst Short-Term Challenges

Despite the recent $660 million loss, Metaplanet’s commitment to its Bitcoin acquisition goal remains unwavering. The company’s strategy is rooted in a long-term vision of building a sustainable and resilient crypto ecosystem. While the path ahead is fraught with challenges, Metaplanet’s diversified approach and strategic investments in blockchain technology position it to navigate the volatile crypto market. As the industry continues to evolve, Metaplanet’s ability to adapt and innovate will be crucial in achieving its ambitious targets.