Bitcoin (BTC) experienced a rollercoaster of volatility on Monday, as low-volume trading during a US bank holiday sparked short-term market manipulation. The cryptocurrency saw sharp price movements within a narrow range, affecting both long and short positions.

Breakouts and Shakeouts: A Day of Liquidity Squeezes

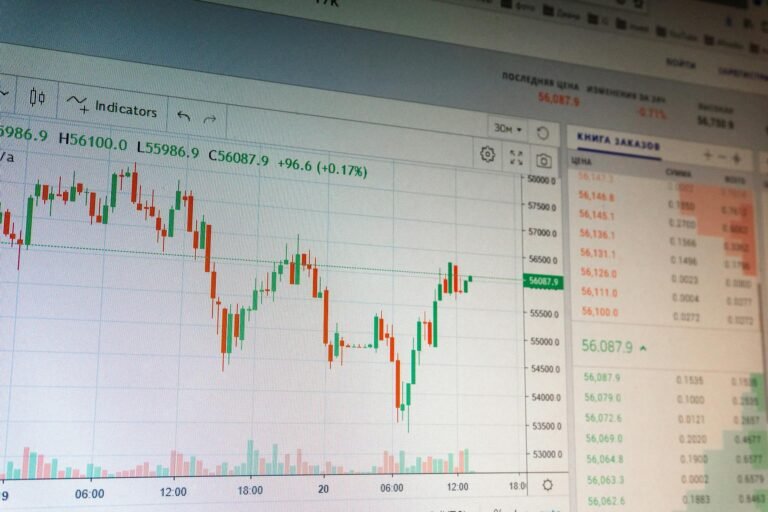

Data from TradingView captured these intense moves, with Bitcoin’s price fluctuating sharply within a $70,000 cap. With Wall Street closed, thinner order books made it easier for large-volume entities to influence short-term price action, leading to multiple ‘squeezes’ that impacted traders on both sides.

According to CoinGlass, a monitoring resource, there were $120 million in crypto liquidations over a four-hour period. Blocks of bids and asks were cleared, with new ‘walls’ placed immediately above the price as it fell, adding to the downward pressure.

“Volatility is much higher, which is something we also see in pretty much all other markets lately. Definitely not a calm period for markets around the world,” commented trader Daan Crypto Trades in a post on X.

Historical Volatility and Market Patterns

Daan Crypto Trades also highlighted the historical volatility of Bitcoin, noting that the current market environment is far from stable. Material Indicators, a trading resource, described the latest BTC price performance as ‘breakouts and shakeouts,’ monitoring both liquidity and whale activity on Binance’s BTC/USDT pair.

Trader CW observed that buying pressure was more robust than on Sunday, with the exception of exchange OKX. This suggests that despite the volatility, there are still pockets of buying interest in the market.

RSI Signals Potential Bottoming Phase

Continuing the analysis, Material Indicators cofounder Keith Alan emphasized the ongoing resemblances between the current market and Bitcoin’s 2022 bear market. He pointed out that the Relative Strength Index (RSI) readings on weekly time frames were pointing to a potential BTC price bottoming phase.

“Finding more similarities with 2022 in the $BTC chart as Weekly RSI moves towards what has historically been, once per cycle lows in oversold territory,” Alan noted on X. “In 2015 and 2018 it marked bottom, however in 2022 it led to a 5-month consolidation before establishing a macro bottom.”

The weekly RSI measured 27.8 on Monday, the lowest reading since June 2022. Readings below 30 are generally considered ‘oversold.’ While this doesn’t guarantee a repeat of past patterns, it’s a signal worth watching closely for potential market turning points.

Looking Ahead: A Cautionary Outlook

While the current market conditions are reminiscent of the 2022 bear market, it’s important to approach any investment decisions with caution. The high volatility and liquidity squeezes indicate a market that is still finding its footing. Traders and investors should conduct thorough research and be prepared for continued fluctuations.

“This doesn’t mean it has to develop the same way this time, but it’s worth watching closely to identify similarities and deviations in the pattern to help with forecasting,” Alan added.

As the market continues to evolve, staying informed and adaptable will be key to navigating the challenges and opportunities ahead.