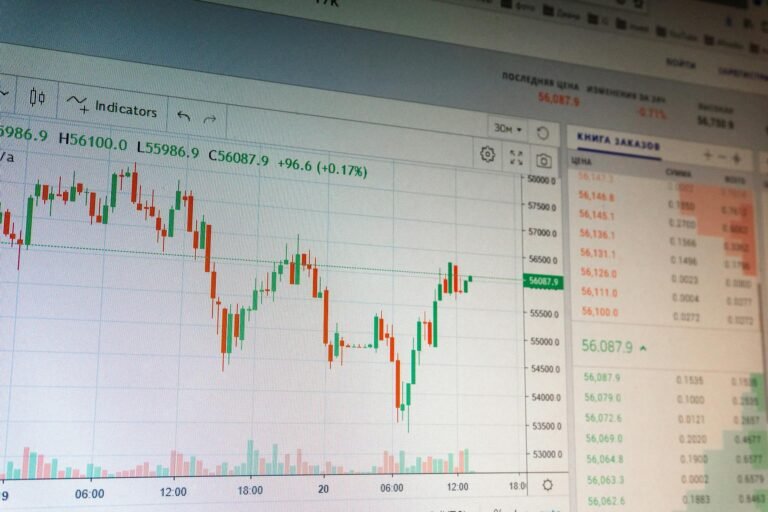

The digital asset XRP faces a murky future as analysts predict a possible price decline to below $1 by 2026, exacerbated by the Federal Reserve’s recent proposal to categorize it under new risk parameters. This move could have significant implications for the cryptocurrency’s market position and regulatory status.

The Fed’s Proposal and Its Impact

The Federal Reserve staff’s proposal to create a new risk category for certain cryptocurrencies, including XRP, is a significant step that could influence how financial institutions handle these assets. The proposal, which is still in its early stages, suggests that XRP and similar tokens could be subject to stricter regulatory scrutiny, potentially leading to reduced liquidity and increased risk aversion among investors.

Market Sentiment and Analyst Predictions

Market sentiment for XRP has been volatile, with some analysts warning of a continued decline. According to Cody Carbone, a crypto market analyst, the normalization of XRP’s price toward $1 or lower is a realistic possibility. “The regulatory headwinds and market dynamics are not in XRP’s favor, and we could see a sustained period of price weakness,” Carbone noted.

However, not all experts are bearish. Mike McGlone, a senior analyst at Bloomberg, believes that while the short-term outlook is uncertain, the long-term potential of XRP and the Ripple network remains strong. “Ripple’s technological advancements and ongoing partnerships could provide a solid foundation for recovery,” McGlone said.

Technological and Strategic Advancements

Ripple, the company behind XRP, has been actively working on technological and strategic advancements to bolster its position. The company’s focus on cross-border payments and financial inclusion has led to several high-profile partnerships, including a recent agreement with Standard Chartered to explore the use of XRP for cross-border transactions.

Additionally, Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) has been a significant factor in XRP’s market performance. While the outcome of the lawsuit remains uncertain, any positive resolution could provide a significant boost to XRP’s price and market sentiment.

Regulatory Landscape and Market Dynamics

The regulatory landscape for cryptocurrencies is rapidly evolving, with different jurisdictions taking varied approaches. In the U.S., the SEC’s stance on XRP as a security has been a major point of contention. The Fed’s new proposal adds another layer of complexity, potentially influencing how financial institutions and investors perceive and interact with XRP.

Internationally, the regulatory environment is also in flux. Countries like Brazil and Hong Kong are exploring regulatory frameworks that could impact the adoption and use of XRP and other cryptocurrencies. The global nature of the crypto market means that regulatory developments in one region can have ripple effects across the entire ecosystem.

Conclusion

The future of XRP remains uncertain, with analysts divided on its short-term prospects. While the Fed’s proposal and ongoing regulatory challenges pose significant risks, Ripple’s technological innovations and strategic partnerships offer a glimmer of hope. As the regulatory landscape continues to evolve, the resilience and adaptability of the XRP community will be crucial in navigating these challenges and potentially emerging stronger in the long run.