Bitcoin (BTC) experienced a sharp dip below $67,400 on Monday, but a swift recovery is on the horizon, driven by robust order book data and significant long-term accumulation. The digital asset’s resilience is underpinned by aggressive bid positioning and a surge in accumulation, setting the stage for a potential move toward the $80,000–$84,000 range.

Key Indicators Point to Bullish Momentum

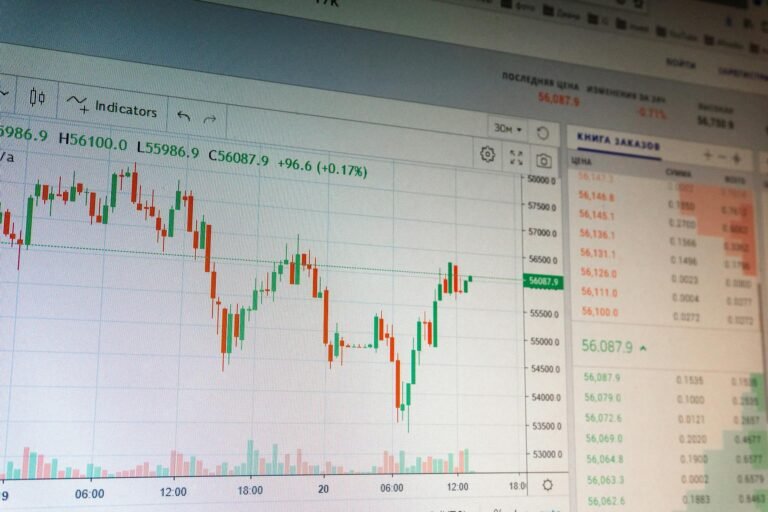

The current market dynamics are characterized by a significant bid skew in Bitcoin’s order books, the largest in over two years. This imbalance, with roughly $596 million in bids versus $297 million in asks within 0–2.5% of the price, signals strong near-term support. Analysts, including Mark Cullen, predict that Bitcoin could retest the $80,000–$84,000 range, a level last seen in early February when the CME gap was formed.

Understanding the CME Gap

A CME gap occurs when Bitcoin futures on the Chicago Mercantile Exchange (CME) close for the weekend and reopen at a different price, leaving a price range with no traded volume. Historically, Bitcoin has revisited these gaps to ‘fill’ them, trading back through the untested range. With 9 out of 10 CME gaps filled since August 2025, the $80,000–$84,000 range stands out as the key unfilled level.

Accumulation Addresses Reach New Highs

CryptoQuant data reveals that the demand from addresses classified as ‘accumulators’ has reached an all-time high of 372,000 BTC on February 15, a significant increase from 10,000 BTC in September 2024. These addresses, filtered using strict criteria, indicate a growing interest in holding Bitcoin for the long term. Analyst Darkfost explained that these criteria include no outflows, multiple inflows, a minimum balance threshold, and the exclusion of exchange, miner, and smart contract wallets.

Long-Term Holder Distribution

The long-term holder (LTH) distribution 30-day sum, which measures the total BTC moved by long-term holders over a rolling 30-day period, has fallen below $100,000. This is a stark contrast to the $1 million average in November 2025. A lower distribution suggests reduced selling from LTHs, which partially offsets whale-driven inflows and supports a bullish outlook.

Market Sentiment and Technical Analysis

Despite the sharp drop below $60,000, demand has picked up near the lows, indicating growing interest in accumulating Bitcoin at discounted prices. The near 2:1 bid-to-ask imbalance in the order book data further reinforces this trend. Crypto trader Dom noted that traders were initially hesitant to buy during the dip, but the subsequent recovery shows a strong appetite for accumulation.

Conclusion

The confluence of robust order book data, significant long-term accumulation, and a historical tendency to fill CME gaps suggests that Bitcoin is poised for a move toward the $80,000–$84,000 range. As the market continues to digest these signals, investors and traders should remain vigilant for further developments that could influence the price trajectory. The current market conditions present a compelling opportunity for those looking to accumulate Bitcoin at potentially favorable levels.