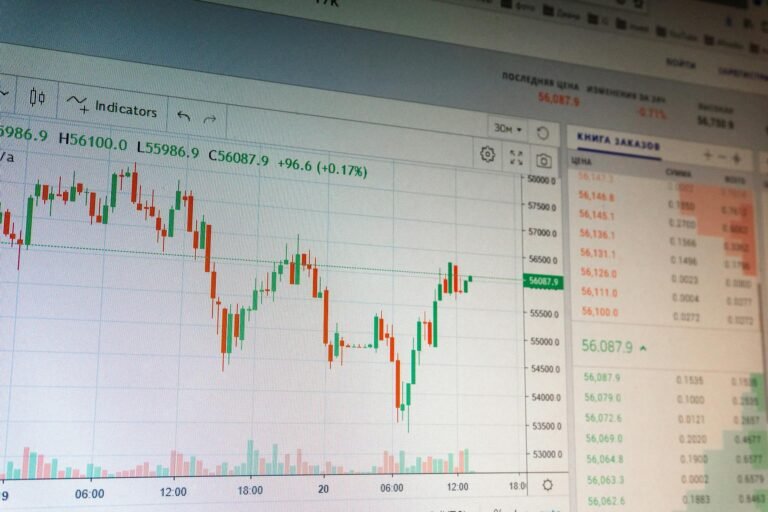

The world of cryptocurrency faced a sharp downturn on February 16, as Bitcoin (BTC) fell below the $68,000 mark, a significant retreat from its recent high of $70,000. The digital asset’s volatility has once again put investors on edge, with the Crypto Fear and Greed Index dipping into the red, signaling ‘extreme fear.’

Market Sentiment Takes a Hit

The retreat from its weekend highs is a stark reminder of the fragility of the crypto market. Despite brief moments of optimism, Bitcoin’s inability to sustain gains above $70,000 has led to a consolidation range between $65,000 and $72,000. Analysts are warning that the market’s deepening bearish sentiment could lead to further declines if not addressed.

Analyst Downgrades Add to the Pressure

The downward trend has not gone unnoticed by industry experts. Several analysts have downgraded their outlooks for Bitcoin, citing a combination of regulatory concerns, macroeconomic factors, and a lack of institutional support. The ongoing debate over the regulation of cryptocurrencies, particularly in the United States, continues to weigh heavily on investor confidence.

What’s Driving the Sell-Off?

One of the primary drivers of the sell-off is the broader economic landscape. Inflation concerns, coupled with the Federal Reserve’s hawkish stance, have created a challenging environment for risk assets, including cryptocurrencies. The uncertainty surrounding global economic recovery has also contributed to the market’s skittishness.

Looking Ahead

Despite the current downturn, some analysts remain cautiously optimistic about Bitcoin’s long-term prospects. They argue that the recent pullback could present a buying opportunity for those with a longer-term investment horizon. However, the immediate challenge is to restore market confidence and address the underlying issues that are driving the bearish sentiment.

The crypto community will be closely watching for any signs of a rebound in the coming weeks. For now, the focus remains on navigating the current storm and positioning for future growth.