In a recent analysis, Stephen Gandel, a prominent financial analyst, has allayed fears that stablecoin rewards will trigger a significant exodus of deposits from traditional banking institutions. While acknowledging that banks may need to adjust their interest rates to remain competitive, Gandel argues that the anticipated deposit flight is largely overblown.

The Stablecoin Conundrum

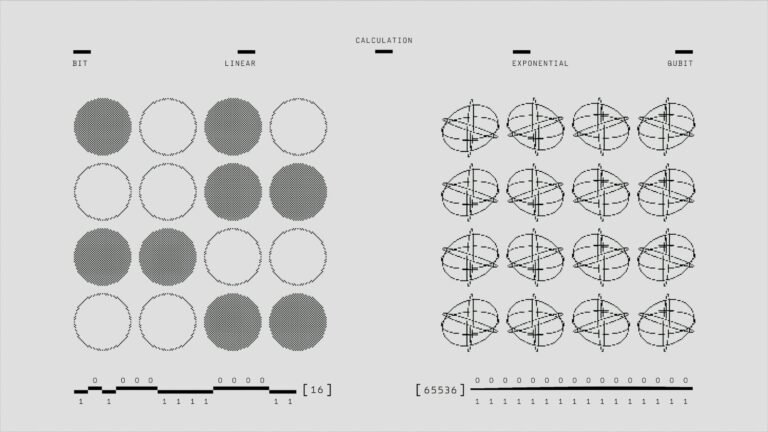

Stablecoins, digital currencies pegged to the value of traditional fiat currencies, have gained traction as a low-volatility alternative to more volatile cryptocurrencies like Bitcoin and Ethereum. Platforms offering high yields on stablecoin deposits have raised concerns that traditional banks could see a mass migration of funds. However, Gandel’s analysis suggests that the impact on the banking system will be more nuanced.

Interest Rates and Bank Profits

One of the primary concerns is that banks will need to offer higher interest rates to retain deposits, potentially squeezing their profit margins. Gandel agrees that this is a valid concern but emphasizes that the overall effect on the banking system will be manageable. ‘Banks will likely need to increase their interest rates, but the scale of deposit flight will not be as dramatic as some have predicted,’ he said.

Stablecoin Adoption and Market Dynamics

The rise of stablecoins has also been driven by their increasing acceptance in various financial applications, from remittances to decentralized finance (DeFi) platforms. Gandel notes that while stablecoins are becoming more integrated into the financial ecosystem, their impact on traditional banking is still limited. ‘Stablecoins are a growing part of the financial landscape, but they are not yet a significant threat to the stability of the banking system,’ he explained.

Long-Term Implications

Looking ahead, Gandel believes that the relationship between stablecoins and traditional banking will evolve. Banks are likely to adopt more digital strategies to compete with the innovative offerings of stablecoin platforms. This could include integrating stablecoin services into their existing products or developing their own digital currencies. ‘The future of banking will be more digital, and banks that adapt will thrive,’ Gandel concluded.

As the financial industry continues to navigate the challenges and opportunities presented by stablecoins, the role of regulatory frameworks will also be crucial. Governments and financial authorities are increasingly focusing on how to balance innovation with stability, ensuring that the benefits of stablecoins can be realized without compromising the integrity of the financial system.