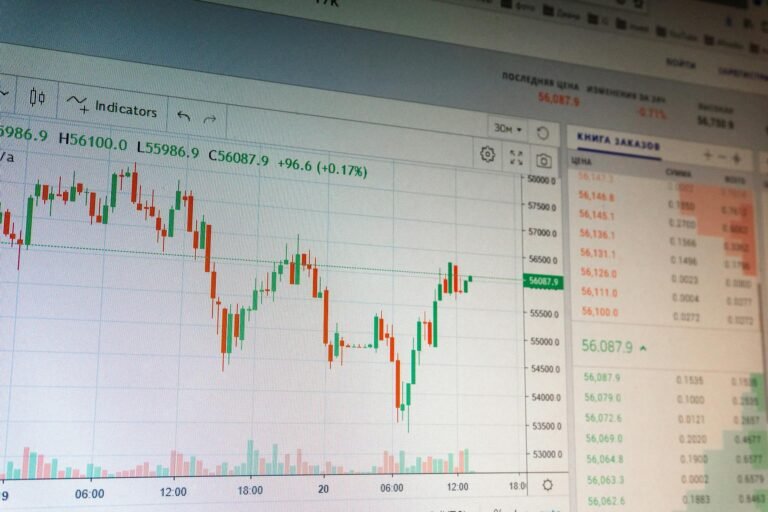

The past week has been a tale of unfulfilled potential for Bitcoin, as the cryptocurrency failed to break through the crucial resistance level of $71,800. After a significant bounce from $60,000, the price action has been tepid, with Bitcoin oscillating around the $68,800 mark as of the week’s close. This lack of momentum is a clear sign that the bulls are struggling to gain control, and the bears remain in the driver’s seat.

Key Support and Resistance Levels

Last week, Bitcoin found support at $65,650, a level that proved crucial as the price dipped just below it before bouncing back. If the price falls below this level, the next support zone is at $63,000. A break below $63,000 could lead to a more significant decline, with the 0.618 Fibonacci retracement at $57,800 acting as a critical support level. Below $57,800, the next major support is at $44,000, which is a much less forgiving territory for bulls.

Resistance Levels and Market Sentiment

On the upside, resistance remains firmly at $71,800. Breaking above this level would open the door to $74,500, with further resistance at $79,000. However, the likelihood of a sustained push beyond $79,000 seems slim at this point. The inability to maintain gains above $71,800 is a significant concern for bulls, as it indicates a lack of buying interest and suggests that the market is currently dominated by sellers.

Outlook for the Week Ahead

With U.S. markets closed on Monday, the week is likely to start slowly. However, the $67,000 level will be a key area to watch early in the week. If this level holds, there is a possibility that Bitcoin could rally and challenge the $71,800 resistance level later in the week. Conversely, if the price breaks below $67,000, it could signal a move back towards the $60,000 support zone.

The Broader Market Context

The crypto market remains under a cloud of uncertainty, particularly with the impending “Crypto Bill” in Congress. The exact timing and content of the bill are still unknown, and its impact on the market is difficult to predict. While some speculate that the bill could provide a bullish catalyst, there is no guarantee that it will lead to higher prices for Bitcoin. For now, traders and investors are relying heavily on technical analysis to navigate the choppy waters.

Conclusion

The coming weeks are likely to see Bitcoin range-bound between $60,000 and $80,000, with a potential dip to the 0.618 Fibonacci retracement at $57,800. The bias remains bearish, and the bulls will need to demonstrate significant strength to break the current downtrend. With the market sentiment currently skewed towards the bears, the next few weeks will be crucial in determining whether Bitcoin can find a foothold or if it will continue its descent.