The crypto market has seen a significant shift in investor sentiment over the past month, with crypto investment funds recording $173 million in net outflows for the fourth consecutive week. This ongoing exodus is raising eyebrows, particularly as Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, lead the trend in withdrawals. The primary drivers appear to be U.S. investors, who have been particularly active in liquidating their positions.

Market Dynamics and Investor Sentiment

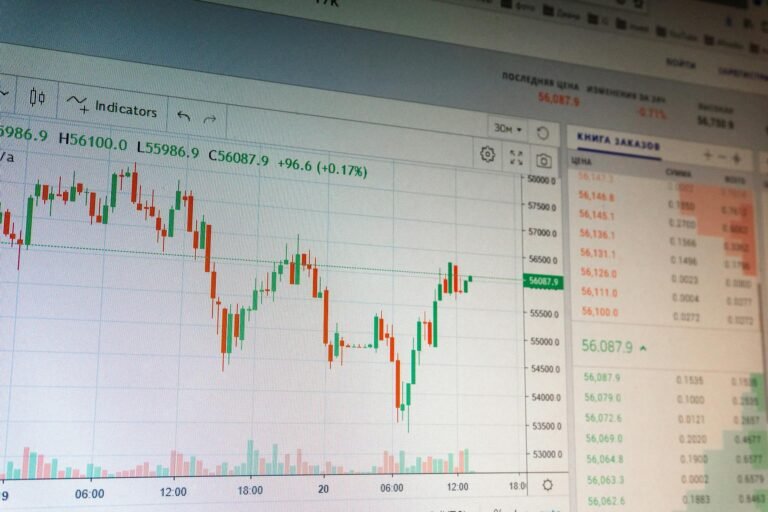

The sustained outflows from crypto investment funds are a clear indicator of a cooling market, but the underlying reasons are multifaceted. Market volatility, regulatory uncertainty, and macroeconomic factors such as rising interest rates and inflation concerns are all contributing to the cautious stance of institutional investors. The bearish sentiment is further exacerbated by the lack of substantial positive news in the crypto space, which has failed to provide a strong catalyst for renewed interest.

Bitcoin and Ethereum: Leading the Charge

Bitcoin, the flagship cryptocurrency, has been at the forefront of these outflows, with a significant portion of the $173 million attributed to its investors. Ethereum, the second-largest crypto by market cap, has also seen substantial withdrawals, reflecting a broader trend of risk aversion among crypto enthusiasts. The decline in institutional participation is particularly notable, as these investors typically have a long-term investment horizon and are less prone to short-term market fluctuations.

U.S. Investors: The Primary Movers

U.S. investors have been the primary drivers of these outflows, with a growing number of institutional players reassessing their crypto allocations. The U.S. regulatory landscape, which has been a source of uncertainty, continues to influence investor decisions. Recent developments, including the SEC’s ongoing scrutiny of major crypto platforms and the lack of clear regulatory guidelines, have added to the caution. Additionally, the broader economic environment, marked by rising interest rates and economic slowdown, has made traditional assets more attractive.

Global Context and Future Outlook

While the U.S. market is a significant player, the global crypto landscape is also showing signs of cooling. European and Asian markets have experienced similar trends, albeit on a smaller scale. The global economic slowdown and the ongoing geopolitical tensions have further dampened investor sentiment. However, experts remain divided on the long-term implications of these outflows. Some analysts argue that this period of consolidation is necessary for the maturation of the crypto market, while others see it as a potential harbinger of a more prolonged downturn.

Looking ahead, the crypto market will need to address several key challenges to regain institutional confidence. Clearer regulatory frameworks, improved security measures, and the development of more robust use cases for blockchain technology are essential. The upcoming months will be crucial in determining whether these outflows represent a temporary correction or a more fundamental shift in the market’s trajectory.