Ethereum (ETH) has started the week with a drop below the critical $2,000 threshold, marking a 20% loss for February. However, despite the price decline, on-chain data reveals a different story, suggesting that a significant rally could be in the making.

Ether Accumulation Grows Amid Price Drop

More than 2.5 million ETH has flowed into accumulation addresses in February, pushing total holdings to 26.7 million ETH, up from 22 million at the beginning of 2026. This significant accumulation, even as the price tumbles, indicates that long-term investors are capitalizing on the dip.

MN Capital founder Michaël van de Poppe noted that ETH’s value against silver is at its lowest level on record. According to van de Poppe, such challenging market conditions often present a long-term accumulation window, a sentiment echoed by many seasoned investors.

Network Demand and Fundamentals Improve

The Ethereum network is also showing signs of robust demand and improved fundamentals. Over 30% of ETH’s circulating supply (37,228,911 ETH) is currently staked, reducing the liquid supply. This staking activity not only supports the network’s security but also limits the amount of ETH available for trading, potentially leading to higher prices.

Weekly transaction counts have hit an all-time high of 17.3 million, while median fees have plummeted to $0.008, a stark contrast to the $25 fees seen during the 2021 peak. Leon Waidmann, head of research at Lisk, highlighted that the current structure reflects higher usage at significantly lower costs, making Ethereum more attractive for both users and developers.

Technical Analysis: Bullish Patterns Emerge

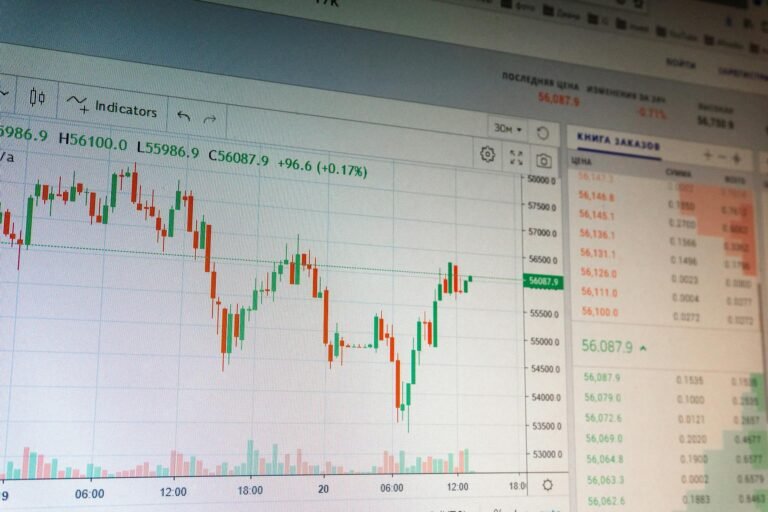

On the four-hour chart, ETH appears to be forming an Adam and Eve bottom, a bullish reversal pattern characterized by a sharp V-shaped low followed by a slower, rounded base. This structure suggests that after an initial aggressive sell-off, buyers are gradually returning, leading to a period of reduced volatility and potential accumulation.

A confirmed breakout above the $2,150 neckline would validate this pattern and could propel ETH toward the $2,473 to $2,634 region. The key short-term liquidity level to watch is $1,909, which acts as a potential magnet for short-term traders.

Derivatives Data: Elevated Leverage and Liquidation Risks

Despite the decline in open interest to $11.2 billion from a peak of $30 billion in August 2025, the estimated leverage ratio remains elevated at 0.7, only slightly down from 0.77 in January. This suggests that leverage is still concentrated in the system, increasing the possibility of a sharp move.

Hyblock data shows that 73% of global accounts are currently long on ETH. Liquidation heatmaps reveal more than $2 billion in short positions clustered above $2,200, compared to roughly $1 billion in long liquidations near $1,800. This imbalance suggests a higher risk of a squeeze to the upside, which could accelerate the rally.

Conclusion: A Promising Outlook for ETH

While the immediate price action of Ethereum may be concerning, the underlying data paints a more optimistic picture. The combination of significant accumulation, improved network fundamentals, and bullish technical patterns suggests that ETH could be on the verge of a substantial rally. Investors and traders should remain vigilant, as the next few weeks could be pivotal for the future of Ethereum.