In a significant move that could reshape the decentralized finance (DeFi) landscape, the Morpho Association and affiliates of Apollo Global Management, Inc., have inked a cooperation agreement aimed at bolstering onchain lending. The deal, signed on February 13, 2026, in Paris, paves the way for Apollo to acquire MORPHO tokens through various mechanisms, including open-market purchases, over-the-counter transactions, and other strategic arrangements, up to a specified cap.

Strategic Implications of the Partnership

The collaboration between Morpho Association and Apollo Global Management underscores the growing interest of traditional financial institutions in the DeFi sector. Apollo, known for its expertise in asset management and financial services, is now positioning itself to leverage the innovative capabilities of the Morpho Protocol. This move is expected to enhance liquidity and stability within the onchain lending market, which has been a critical area of focus for both DeFi enthusiasts and institutional investors.

Enhancing Onchain Lending

Onchain lending, a cornerstone of DeFi, allows users to borrow and lend digital assets in a trustless and decentralized manner. The Morpho Protocol, a leading player in this space, has been at the forefront of developing solutions that improve the efficiency and accessibility of onchain lending. By partnering with Apollo, Morpho aims to integrate traditional financial practices with cutting-edge blockchain technology, thereby creating a more robust and resilient financial ecosystem.

Apollo’s Role in the DeFi Ecosystem

Apollo’s entry into the DeFi space is not just a strategic investment but a testament to the maturing and mainstream acceptance of blockchain technology. The firm’s acquisition of MORPHO tokens will provide it with a stake in the protocol’s governance, enabling it to influence the direction and development of the Morpho ecosystem. This partnership also signals a broader trend of institutional adoption, as more established financial players recognize the potential of DeFi to disrupt and enhance traditional financial services.

Market Impact and Future Outlook

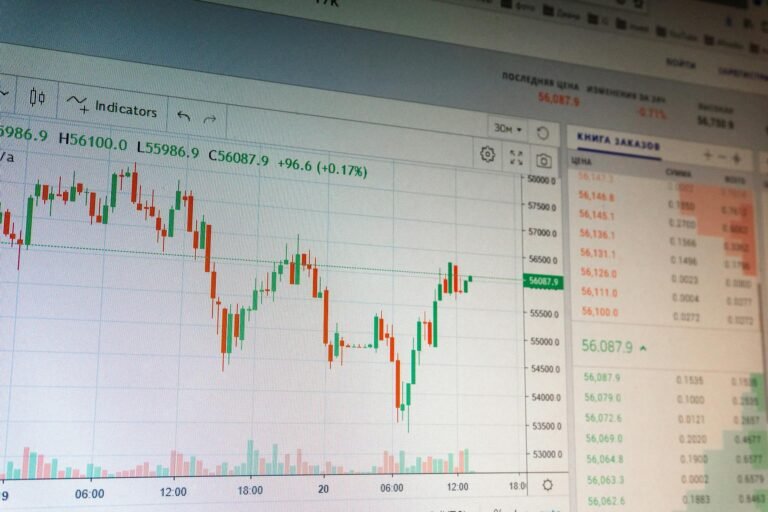

The announcement of this partnership has already sent ripples through the crypto community, with MORPHO tokens experiencing a notable uptick in trading volume and price. Analysts predict that the influx of institutional capital and expertise will further solidify Morpho’s position in the DeFi market, potentially leading to increased adoption and innovation. However, the road ahead is not without challenges, as regulatory scrutiny and market volatility remain significant hurdles.

As the DeFi sector continues to evolve, the collaboration between Morpho Association and Apollo Global Management sets a precedent for how traditional and decentralized finance can coexist and mutually benefit. The success of this partnership could serve as a blueprint for future collaborations, driving the DeFi industry towards greater maturity and widespread acceptance.