The crypto world is bracing for a significant shift as we officially enter the ‘crypto tax enforcement era.’ This new phase, driven by stringent regulatory measures, marks a pivotal moment for the industry. However, the rules, crafted by regulators who often lack a deep understanding of the technology, could have far-reaching consequences for both crypto enthusiasts and businesses alike.

The Dawn of a New Era

The crypto tax enforcement era is not just a regulatory blip; it represents a fundamental change in how cryptocurrencies are perceived and managed by governments worldwide. The Internal Revenue Service (IRS) and other tax authorities are tightening the screws, demanding more transparency and accountability from crypto exchanges, wallets, and users.

Regulatory Overhaul

The new regulations are comprehensive, covering everything from transaction reporting to the valuation of digital assets. For instance, the Infrastructure Investment and Jobs Act in the United States now requires crypto brokers to report transactions to the IRS, similar to traditional financial institutions. This move is aimed at closing the tax gap and ensuring that crypto profits are taxed appropriately.

Challenges and Concerns

While the intent behind these regulations is clear, the implementation is fraught with challenges. Many in the crypto community argue that the rules are overly broad and fail to account for the unique nature of blockchain technology. For example, the definition of a ‘broker’ in the new regulations is so broad that it could potentially include developers, miners, and even individuals who participate in decentralized finance (DeFi) protocols.

Impact on the Industry

The ripple effects of these regulations are already being felt. Crypto exchanges are scrambling to comply, which has led to increased operational costs and, in some cases, reduced user privacy. Some platforms have even decided to halt certain services or exit jurisdictions where compliance is particularly burdensome. This could stifle innovation and drive businesses and users to less regulated markets.

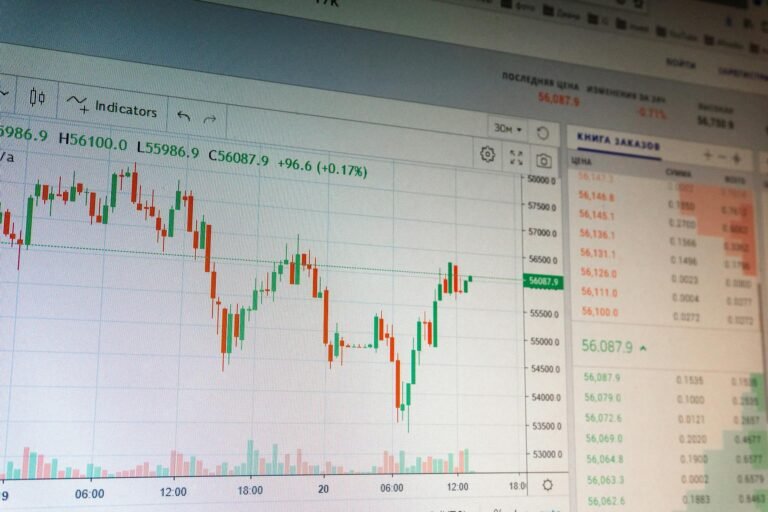

Investor Sentiment

Investor sentiment is another area of concern. The uncertainty surrounding tax regulations can deter both retail and institutional investors. The fear of unexpected tax liabilities and complex reporting requirements may lead to a reduction in investment and trading activities, potentially stifling the growth of the crypto ecosystem.

The Path Forward

Despite the challenges, the crypto industry is not standing still. Many companies are investing in compliance solutions and educating users about their tax obligations. There is also a growing push for clearer and more tailored regulations that better reflect the realities of the crypto space.

Expert Insights

According to Michael Saylor, CEO of MicroStrategy, the current regulatory environment is a double-edged sword. ‘While it brings much-needed clarity and legitimacy to the industry, it also poses significant operational challenges,’ he said. ‘The key is to find a balance between regulation and innovation.’

Conclusion

The crypto tax enforcement era is here, and it is a turning point for the industry. While the regulations aim to bring order and transparency, they also introduce new challenges and uncertainties. The onus is now on the crypto community to navigate these waters, advocate for sensible regulations, and continue to innovate. The future of crypto is not in doubt, but the path forward will require collaboration, adaptability, and a deep understanding of the evolving regulatory landscape.